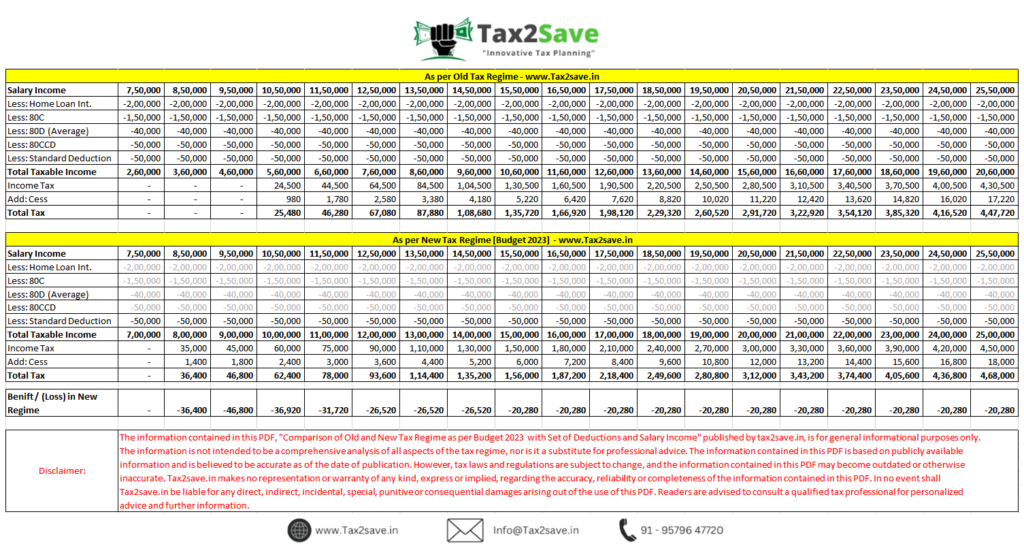

The 2023 Budget has introduced a new tax regime for individuals with a salary income between 7.5 to 25.5 lakhs, offering lower tax rates but with fewer deductions compared to the old regime. In this guide, we will compare the new and old tax regimes for various salary groups between 7.5 to 25.5 lakhs.

For each salary group, we will highlight the key differences between the two regimes, including the exemptions and deductions allowed in the old regime but not in the new regime. We will also provide a comparison of the net take-home salary for each regime to help individuals understand the impact of choosing either regime.

Here’s a sample comparison for a salary income of Rs 10.5 lakhs:

Old regime:

Total taxable income: Rs 10,5 lakhs

Total deductions: Rs 4,90 lakhs (Home loan interest, 80C, 80D, 80CCD & std Deduction)

Taxable income: Rs 5.6 lakhs

Total tax liability: Rs 25,480

Net take-home salary: Rs 10,24,520

New regime:

Total taxable income: Rs 10.5 lakhs

Total deductions: Rs NIL (NIL)

Taxable income: Rs 10.5 lakhs

Total tax liability: Rs 62,400

Net take-home salary: Rs 9,87,600

In this scenario, the net benefit of the old regime is Rs 36,920 as compared to the new regime. However, this calculation may vary based on individual circumstances and the exemptions and deductions availed.

To view the complete comparison of the new vs old tax regimes for various salary groups between 7.5 to 25.5 lakhs, please refer to the comparison chart below and you can also download the image below.